NVDA Stock Split Ignites Wall Street Buzz as Nvidia Enters New Era

The moment traders refreshed their screens, something felt different. A familiar ticker, already dominating headlines, had just sparked a new wave of excitement. Retail investors leaned in. Institutions recalculated. Social media lit up with speculation. The nvda stock split wasn’t just another corporate action—it felt like a signal. A statement. In a market driven by psychology as much as performance, Nvidia once again found a way to command attention, stir emotion, and reshape the conversation around growth, access, and the future of American tech leadership.

What the NVDA Stock Split Really Means for Investors

At its core, the nvda stock split is a mechanical move. Nvidia increased the number of outstanding shares while proportionally reducing the share price. The company’s market capitalization remains the same, and the intrinsic value doesn’t magically change overnight. Yet history shows that stock splits often carry meaning beyond math. They can reflect management confidence, sustained growth expectations, and a desire to keep shares accessible to a broader range of investors.

For Nvidia, the timing matters. The company is riding unprecedented momentum fueled by artificial intelligence demand, data center expansion, and dominance in advanced semiconductor design. Executing a split during such strength sends a subtle message to Wall Street: leadership believes the growth story is far from over. That psychological boost often translates into increased trading volume, renewed media coverage, and heightened interest from long-term holders.

Why Nvidia Chose This Moment for a Stock Split

Nvidia’s decision did not happen in isolation. The company has seen explosive gains, pushing its share price into territory that can feel intimidating for everyday investors. Historically, companies initiate splits after prolonged rallies to improve liquidity and market participation. The nvda stock split follows this classic pattern, aligning with Nvidia’s transformation from a niche graphics company into a backbone of the global AI economy.

Another factor is optics. A lower post-split share price often feels more “affordable,” even if valuation metrics remain unchanged. That perception matters in a retail-driven era where accessibility fuels enthusiasm. With Nvidia already one of the most discussed stocks in the United States, the split amplifies visibility at a moment when attention itself has become a competitive advantage.

Historical Performance After Nvidia Stock Splits

Looking back, Nvidia has executed multiple stock splits over its public history. Each one occurred during periods of strong operational performance and expanding demand for its technology. While past results never guarantee future returns, Nvidia’s track record shows that splits often coincided with continued long-term appreciation rather than stagnation.

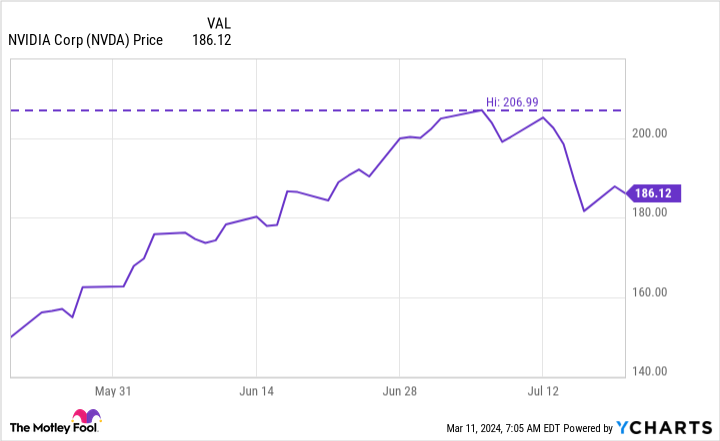

Market data reveals a recurring pattern. Following previous splits, Nvidia typically experienced short-term volatility, followed by stabilization and renewed upward momentum. This trend reinforces why the nvda stock split has captured headlines. Investors aren’t just reacting to the event itself; they’re extrapolating from history, betting that Nvidia’s innovation engine will once again justify optimism.

Wall Street Reaction and Market Sentiment Shift

Analysts were quick to weigh in. Major investment banks reiterated bullish outlooks, emphasizing that the nvda stock split does not alter fundamentals but may improve trading dynamics. Volume spikes and options activity suggested heightened engagement across both retail and institutional players. In financial media, the narrative shifted from “how high is too high” to “how long can this run last.”

Sentiment indicators reflect that change. Mentions of Nvidia across investor forums surged, while search interest climbed sharply in the United States. This matters because sentiment often precedes capital flows. When enthusiasm aligns with earnings strength and sector leadership, it can reinforce momentum, at least in the near term.

How the Stock Split Impacts Retail Investors

For individual investors, the nvda stock split offers psychological and practical benefits. Lower per-share prices allow more flexibility in position sizing, especially for those using dollar-cost averaging strategies. It also makes Nvidia more accessible for younger investors or those building diversified portfolios with limited capital.

There’s also an options market effect. Post-split contracts typically become more affordable, increasing participation and liquidity. While none of this changes Nvidia’s valuation overnight, it can alter how investors interact with the stock. That engagement, in turn, can support demand during periods of market uncertainty.

Institutional Strategy After the NVDA Stock Split

Large funds view splits differently. Institutions focus on earnings growth, margins, and long-term competitive positioning. Still, the nvda stock split can influence rebalancing decisions, particularly for funds with price-weighted constraints or liquidity considerations. Increased share count often improves daily trading efficiency, which institutions value when managing large positions.

Additionally, the split aligns Nvidia with other mega-cap technology leaders that have used similar strategies during growth phases. This places Nvidia firmly within the top tier of U.S. market darlings, reinforcing its role as a core holding in many technology and innovation-focused portfolios.

Nvidia’s AI Dominance and Its Role in the Split Decision

The backdrop to the nvda stock split is Nvidia’s commanding position in artificial intelligence infrastructure. Its GPUs power everything from cloud data centers to generative AI platforms reshaping entire industries. Revenue from data center segments has surged, contributing to record-breaking earnings and expanding margins.

This AI-driven growth story is not theoretical. Enterprises, governments, and startups are racing to secure Nvidia hardware, often facing supply constraints. Against this backdrop, the split appears less like a cosmetic move and more like a strategic milestone marking Nvidia’s evolution into a foundational technology provider for the global economy.

Risks and Realities Investors Should Not Ignore

Despite the excitement, the nvda stock split does not eliminate risk. Valuation remains elevated compared to historical norms, and expectations are high. Any slowdown in AI spending, increased competition, or macroeconomic shock could trigger sharp corrections. Investors chasing post-split momentum without understanding fundamentals may expose themselves to volatility.

There’s also the broader market context. Interest rate uncertainty, regulatory scrutiny, and geopolitical tensions can impact technology stocks disproportionately. While Nvidia’s leadership position offers resilience, no company is immune to systemic risks. Balanced analysis remains essential.

Short-Term Volatility Versus Long-Term Opportunity

In the days following a split, stocks often experience turbulence. Profit-taking, speculation, and media hype can create sharp swings. The nvda stock split is unlikely to be different. However, long-term investors typically view these periods as noise rather than signals.

What matters more is Nvidia’s ability to sustain earnings growth, defend margins, and stay ahead in innovation. If those pillars remain intact, the split becomes a footnote in a much larger story of technological transformation and shareholder value creation.

What This Means for the U.S. Stock Market

Nvidia’s influence extends beyond its own ticker. The nvda stock split has implications for major indices, sentiment toward semiconductor stocks, and confidence in the broader technology sector. As one of the largest market-cap companies in the United States, Nvidia’s movements can sway benchmarks and shape investor psychology.

The split also reinforces a narrative of American tech leadership at a time when global competition is intensifying. For many investors, Nvidia symbolizes not just profit potential, but strategic relevance in the next wave of digital infrastructure.

Future Outlook After the NVDA Stock Split

Looking ahead, analysts project continued revenue growth driven by AI adoption, enterprise demand, and expanding use cases. While growth rates may normalize over time, Nvidia’s ecosystem advantage remains formidable. The nvda stock split positions the company for broader participation in that journey, potentially widening its shareholder base.

Future catalysts include earnings reports, product launches, and updates on supply capacity. Each will test whether Nvidia can meet the elevated expectations now embedded in its stock price. The split doesn’t guarantee success, but it underscores confidence in the road ahead.

Final Takeaway for Investors Watching Nvidia Closely

The nvda stock split is more than a headline. It’s a moment that captures Nvidia’s ascent, investor enthusiasm, and the evolving dynamics of modern markets. While the move doesn’t change fundamentals, it reshapes perception, accessibility, and engagement around one of America’s most influential companies.

If you’re tracking Nvidia or considering exposure to the AI revolution, now is the time to look beyond the split and study the story underneath. Stay informed, analyze the risks, and follow the data—not just the buzz. For investors who want to understand where the market may be heading next, this is a conversation worth staying part of.